How often will I receive alerts from digital banking?

The frequency of alerts you receive depends on the type of alerts you set up.

Account Alerts

For card alerts, go to the Card Alerts section

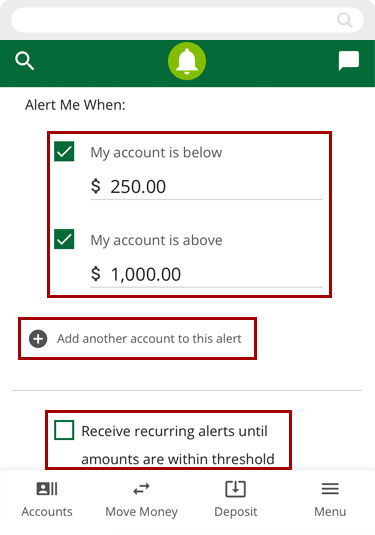

Balance Alerts

You will get an alert any time your balance falls above or below the amount you enter on the account(s) you select. You can also choose to receive recurring alerts until the balance is within your threshold.

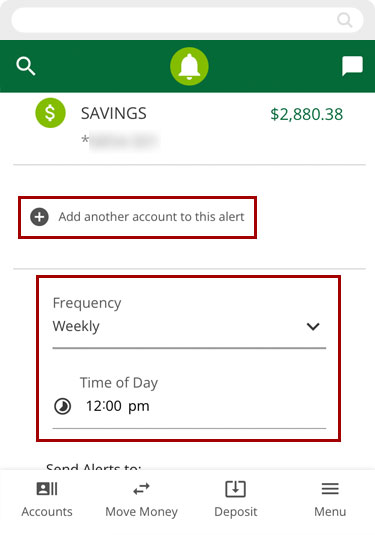

Balance Summary Alerts

You can set a daily or weekly alert to provide a summary of the balance on the account(s) you select.

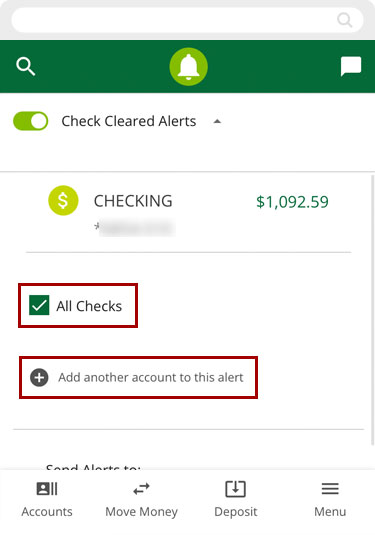

Check Cleared Alerts

You will get an alert any time a check clears on the account(s) you select.

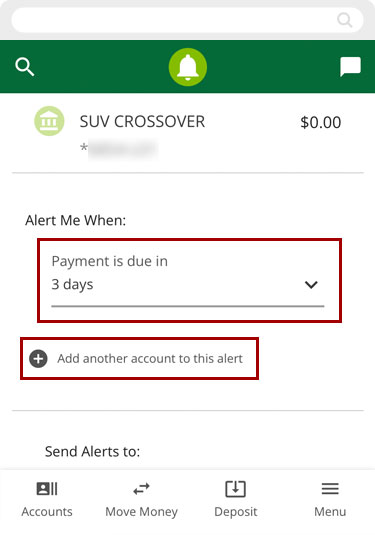

Loan Due Alerts

You can select to get this alert from 1 to 5 days in advance of the payment due date on the loan(s) you select.

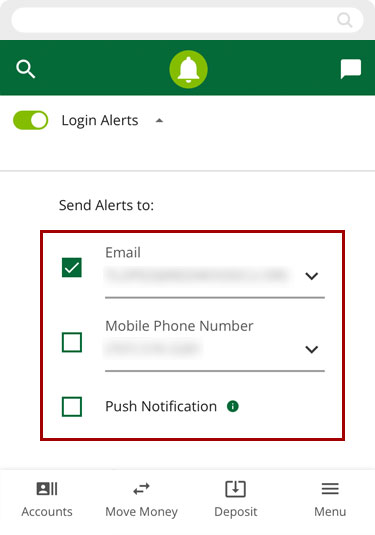

Login Alerts

You will get an alert any time you log in to your account.

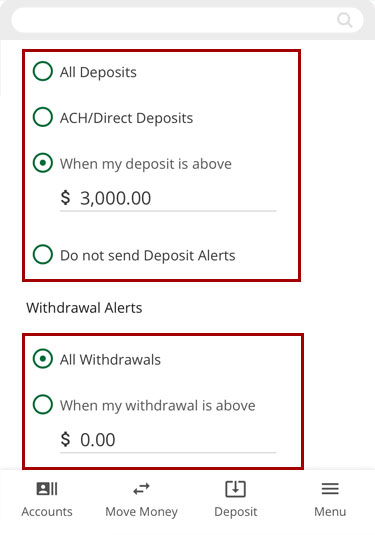

Transaction Alerts

You can choose to get deposit and/or withdrawal alerts with the following options: All Deposits, All Withdrawals, ACH/Direct Deposits, when a deposit and/or withdrawal is above the amount you enter on the account(s) you select.

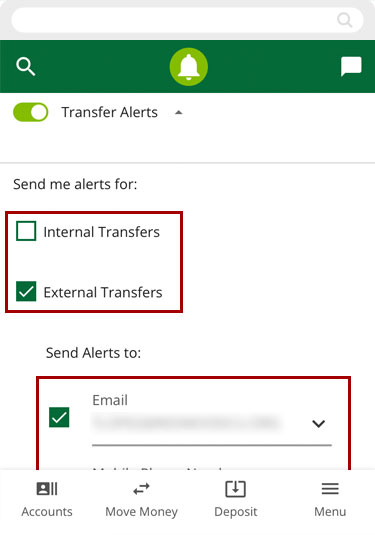

Transfer Alerts

You will get an alert any time internal and/or external transfers have been made on the account(s) you select.

Card Alerts

For account alerts, go to the Account Alerts section

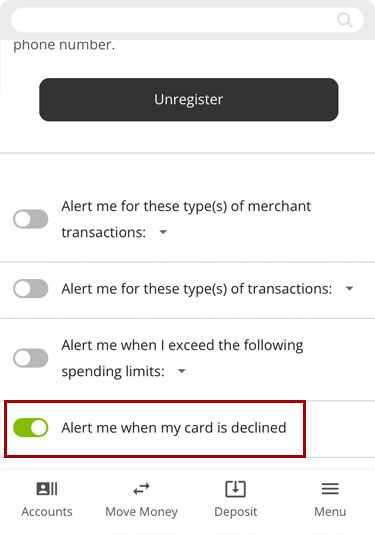

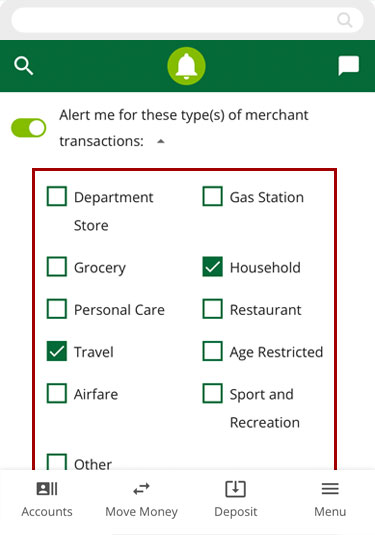

Merchant Transaction Alerts

You will get an alert any time there’s a transaction for the type of purchase you select. E.g. travel, groceries, restaurants, airfare, etc.

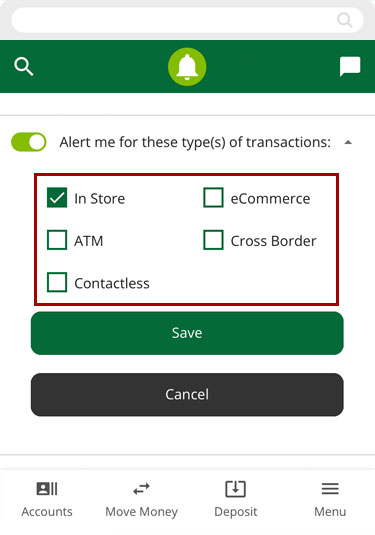

Transaction Type Alerts

You will get an alert any time you make a specific type of transaction like contactless payment, ATM, eCommerce, etc.

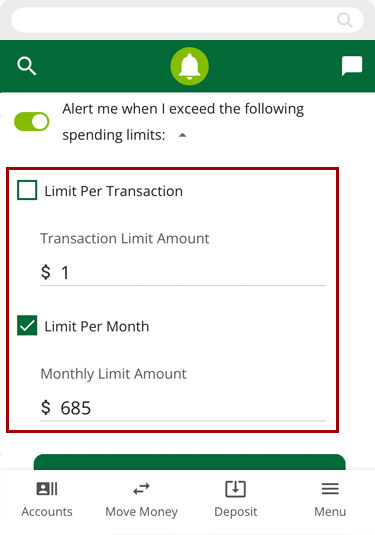

Spending Limits Alerts

You will get an alert any time you make a transaction that exceeds the limit(s) you set up. The limit can be set per transaction or per month.

Declined Card Alerts

You will get an alert any time your card has been declined.