Frequently asked questions (FAQs) about contactless cards

What are contactless payments?

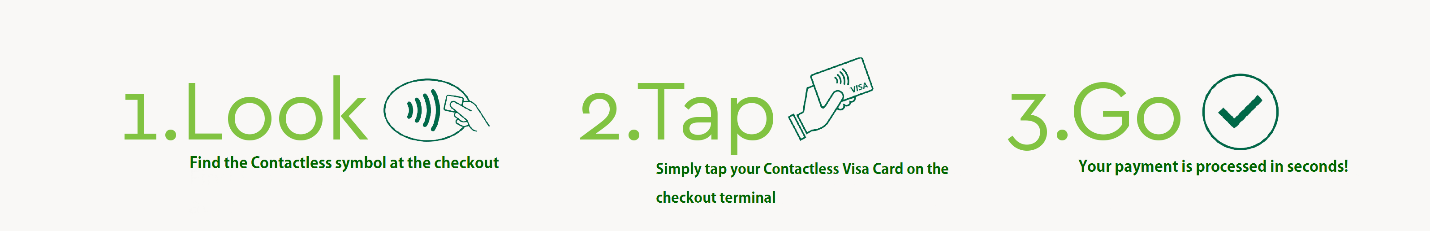

Contactless payments use short-range wireless technology to quickly complete payments between a contactless- enabled card or payment-enabled device and a contactless-enabled checkout terminal. A contactless Visa card is a chip card that has a near-field communication (NFC) antenna, which enables close-range payments. When cardholders tap their contactless card at a contactless-enabled checkout terminal, their payment is sent for authorization.

What do![]() and

and![]() mean?

mean?

When shown on a card, the contactless indicator![]() means the card has the capability to make contactless payments. When shown at a merchant, it means they accept contactless payments. The contactless symbol

means the card has the capability to make contactless payments. When shown at a merchant, it means they accept contactless payments. The contactless symbol![]() shows the cardholder where to tap their contactless card on the checkout terminal to make a contactless payment.

shows the cardholder where to tap their contactless card on the checkout terminal to make a contactless payment.

What are the benefits of contactless payments?

Contactless payments are easy. You simply tap your contactless card on the contactless-enabled checkout terminal. Payments are fast and convenient to use in places where you need to pay on the go. And just like transactions made with a chip card, each contactless card transaction is accompanied by a one-time code that protects the payment information. So your contactless payments are also secure. Unlike cash, contactless payments let you keep better records of your purchases. You can still do everything you would do with a non-contactless card, including adding a tip, getting cash back (if available), and more.

How does this technology compare to mobile wallets, like Apple Pay?

Contactless payments use the same near-field communication (NFC) technology as mobile wallets, such as Apple Pay, Android Pay, and Google Pay.

Where can I use my contactless card?

You can tap to pay wherever you see the contactless symbol![]() at checkout. Millions of merchants around the world accept contactless payments, including fast food restaurants, grocery stores, pharmacies, and more.

at checkout. Millions of merchants around the world accept contactless payments, including fast food restaurants, grocery stores, pharmacies, and more.

How do I use my contactless card at a retailer that is not yet contactless-enabled?

If you don’t see the contactless symbol ![]() , you can still use your contactless card by inserting it at a chip-enabled terminal, or swiping at a magnetic strip terminal.

, you can still use your contactless card by inserting it at a chip-enabled terminal, or swiping at a magnetic strip terminal.

Do my purchases require a signature?

To ensure that using contactless is as simple and convenient, merchants that accept contactless do not require you to sign for purchases. However, for your protection, some merchants may have transactions limits which will require your signature.

Will a PIN be required for contactless transactions?

You may be required to enter a PIN to complete ATM transactions, some debit card purchases, and on rare occasions (depending on the merchant), you may be asked to enter a PIN for purchases with your credit card. This is dependent on whether the merchant has default transactions to PIN-based only.

Will my contactless card work at transit terminals?

Yes. You can use your contactless card on any transit system that accepts contactless card payments.

Why doesn’t my contactless card work at all merchants that offer contactless?

Some merchants may not have the most up-to-date technology installed on their terminals to accept our contactless card. The merchant may also have a purchase limit on contactless transactions. Please use other transaction methods such as inserting chip and/or magnetic swipe.

Are contactless cards safe?

Yes. Every time you use your contactless card at a contactless-enabled terminal, each transaction is accompanied by a one-time code that protects your payment information, just like with chip technology.

Can my contactless card be accidently picked up by a contactless-enabled terminal?

No. Your card must be within 1-2 inches of the contactless-enabled checkout terminal for the transaction to occur. Even if you happen to accidentally tap twice, you will only be billed once for your transaction.

Does the contactless antenna or chip provide an enhanced level of security if I make a purchase using the magnetic stripe on my card or if I make a purchase online?

No. The contactless and chip technology provides an enhanced level of security only when you tap your card or insert your chip card into a chip terminal to make an in-person purchase.

Will contactless cards allow others to track my location?

No. Personal data and card information is not stored on the contactless antenna or on the chip.

Can my card information still be compromised with a contactless card?

Contactless technology is only one layer of security to prevent your contactless card from being fraudulently used and cannot prevent all fraud including, but not limited to, web and phone purchases. We still encourage Members to be alert and aware of potential scams and fraud. You can learn more about what to watch out for at redwoodcu.org/security.

Can people "skim" information off a contactless card?

Not if you are making a contactless transaction. For every contactless transaction, a transaction-specific, one-time code is created that secures your payment information. The code cannot be re-used by fraudsters even if they were somehow able to get ahold of it. The information would be useless to them. Your name and account number are not transmitted from your card. However, if you use your card at a terminal (such as a gas pump) that is not contactless-enabled, it could still be susceptible to skimmers. We encourage Members to be diligent about security when using their cards at a magnetic swipe terminal – here are some tips for spotting skimming devices.