How do I transfer money from my Economic Impact Payment (EIP) card to my RCU account?

The Economic Impact Payment (EIP) card is loaded with the money that you are receiving from the COVID-related Tax Relief Act of 2020 or the Coronavirus Aid, Relief, and Economic Security Act (CARES Act). This card is authorized by the U.S. Department of the Treasury and is managed by MetaBank. Please see your Cardholder Agreement online at EIPCard.com.

- For more information please visit the EIP card website: https://www.eipcard.com/

Transfer funds from your EIP card to your RCU account online

- Activate your EIP card.

- Register by following the steps to create a user ID and password. Be sure to have your EIP card handy.

- Under Money Out, select Transfers in U.S.

- Follow the steps to set up your RCU account as the destination account using your RCU account number and RCU’s routing number (see below).

Transfer funds from your EIP card to your RCU account using the Money Network Mobile App:

- Activate your EIP card.

- Download the Money Network Mobile App2 and register for mobile access by clicking “New User?” Follow the steps to create your user ID and password. Be sure to have your EIP card handy.

- Click the top left menu and under Move Money Out, click Send Money to an External Bank Account.

- Follow the steps to set up your RCU account as the destination account using your RCU account number and RCU’s routing number (see below).

Set Up a transfer by phone by calling EIP cards

- Activate your EIP card.

- Call 1 (800) 240-8100 and follow the interactive prompts to authenticate your card.

- Once authenticated, follow the prompts to set up your destination bank account using your RCU account number and RCU’s routing number (see below).

Transfers using any of these methods should post to your RCU account in 2-3 business days. You can conveniently transfer up to $6,000 at one time, from home or on the go.

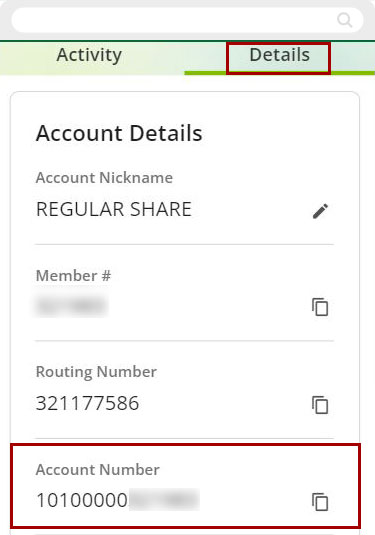

Redwood Credit Union's routing and transit (ABA) number

Redwood Credit Union's routing number is 321177586.

This number applies to all RCU branches and locations, as well as all account types, including Savings, Checking and Investment accounts.

Use digital banking to find your direct deposit info

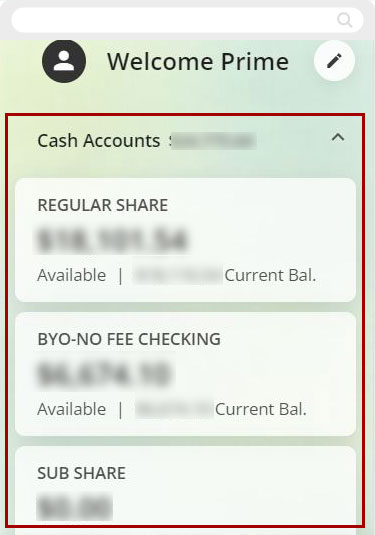

Mobile

If you're using a mobile device, follow the steps below. For computers, go to the desktop steps

You might already be familiar with your 6- or 9-digit RCU Member number, but sometimes you may need to know your full 14-digit account number for certain transactions, such as setting up direct deposits or certain types of payments. Here are the steps to view your full account number in digital banking:

Once you have logged in, tap the desired account.

On the account page, tap Details to see your full account number.

Desktop

If you're using a computer, follow the steps below. For mobile devices, go to the mobile steps

Once you have logged in, click the desired account.

.jpg)

On the account page, click Details to see your full account number.

.jpg)

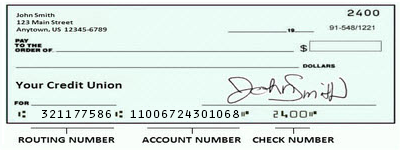

Use a printed check to find your direct deposit info

You can also find your checking account number listed in the second string of numbers printed along the bottom of your checks.