Business ACH Services: Overview in Digital Banking

To begin, you will need to apply for access to ACH services. You can access Business ACH once you have been approved for these services.

Mobile

If you're using a mobile device, follow the steps below. For computers, go to the desktop steps

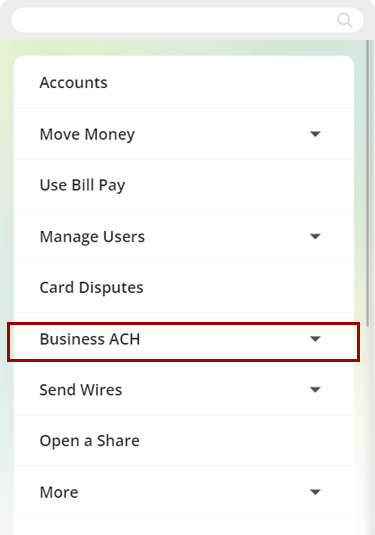

Tap on the menu on the lower right and select Business ACH.

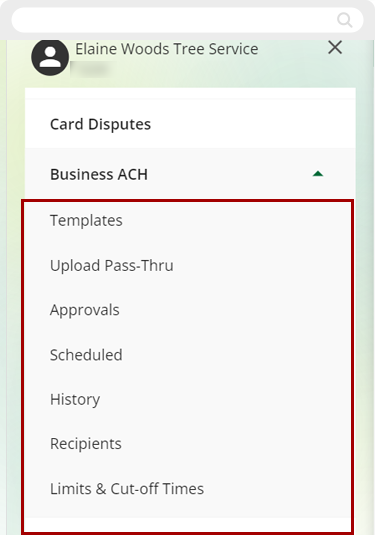

Once you select Business ACH, you will see the following options at left to help manage your Business ACH services.

Business ACH consists of the following areas:

- Templates: The “wrapper” around an individual or group of recipients used to process transactions.

- Upload Pass-Thru: Gives you the ability to upload files from your current payroll or invoicing system.

- Approvals: Once a template or file has been submitted, you must approve the file for Redwood Credit Union to process it.

- Scheduled: Here, you can view, cancel, or edit pending transactions.

- History: Shows transactions that have been processed.

- Recipients: The individuals or companies for whom you have scheduled debit or credit transactions.

- Limits & Cut-off Times: Displays your current daily and monthly limits along with the cutoff time for processing.

Desktop

If you're using a computer, follow the steps below. For mobile devices, go to the mobile steps

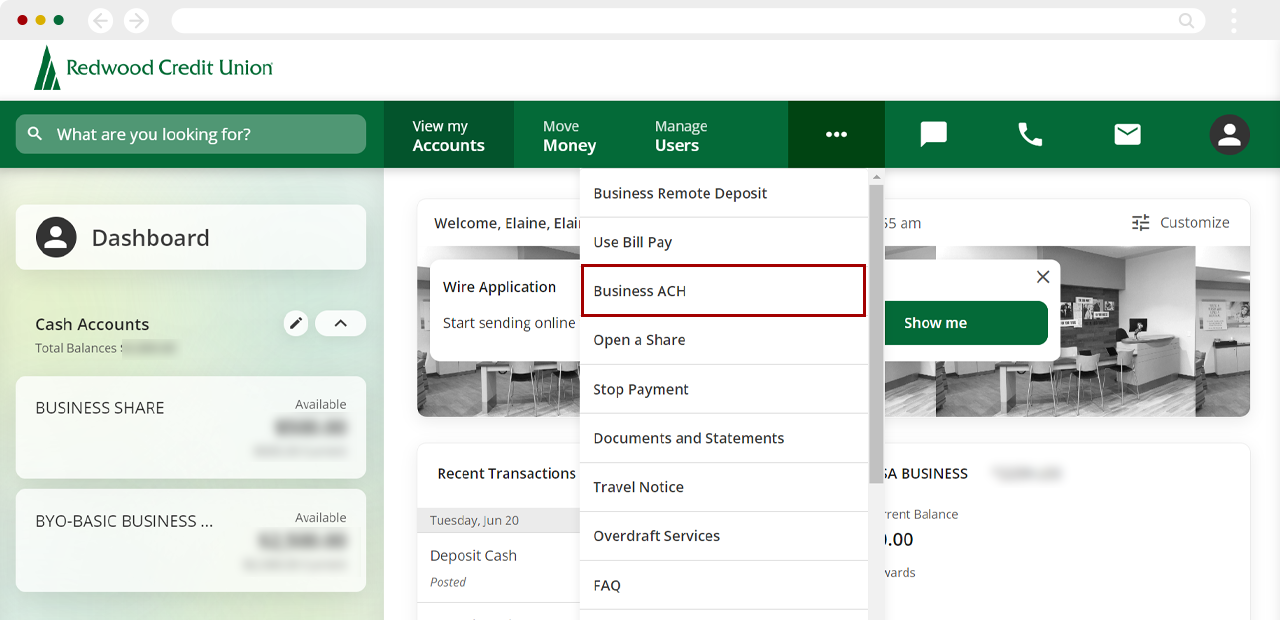

Depending on your display, you may see Business ACH in your dashboard, or you may need to click the 3 dots in the upper menu bar and select Business ACH.

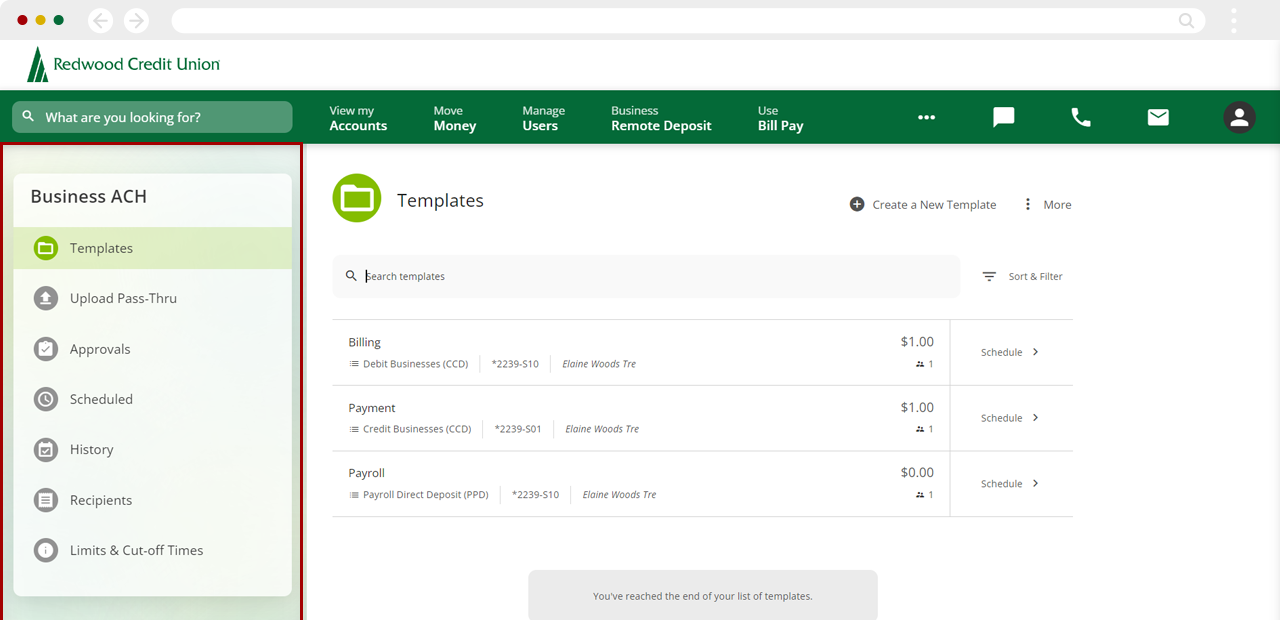

Once you select Business ACH, you will see the following options at left to help manage your Business ACH services.

Business ACH consists of the following areas:

- Templates: The “wrapper” around an individual or group of recipients used to process transactions.

- Upload Pass-Thru: Gives you the ability to upload files from your current payroll or invoicing system.

- Approvals: Once a template or file has been submitted, you must approve the file for Redwood Credit Union to process it.

- Scheduled: Here, you can view, cancel, or edit pending transactions.

- History: Shows transactions that have been processed.

- Recipients: The individuals or companies for whom you have scheduled debit or credit transactions.

- Limits & Cut-off Times: Displays your current daily and monthly limits along with the cutoff time for processing.