Tips for managing your checking account

We offer a variety of options to help you avoid overspending or to cover you in case you do.

Overview

As a credit union, our focus isn’t profit—it’s helping you succeed financially. And that includes helping you learn more about how to avoid fees.

Sometimes an unexpected life event or an occasional mistake can leave you short of funds. In these cases, RCU offers services to provide you a safety net if you accidentally overdraw your account.

Ways to help protect yourself from overdrawing your account

Email & Text Alerts

Set up alerts in online or mobile banking and receive a text message or email when your account balance is low.

Overdraft Transfers

Set up your savings and/or money market account to transfer funds to your checking in $100 increments in the event that you overdraft.

Free Financial Resources

Take advantage of free access to industry-leading financial education and resources, with tips for every step of your financial journey.

Additional Services

Overdraft Line of Credit

If you’re short on funds, pull from an overdraft line of credit to advance funds in $100 increments from your low, fixed rate loan to your checking.

Overdraft Pay Advantage (OPA)

This optional program provides a safety net for occasions when you don’t have enough funds to pay for a transaction—we’ll cover the payment to ensure it goes through.

Overdraft Transfers

Set up your savings and/or money market account to transfer funds to your checking account in $100 increments in the event that you overdraft.

Key features

- No fees.

- Easy, one-time setup for automatic transfers.

- Unlimited monthly transfers (as long as the “transfer from” account has at least $100 available).

Overdraft Line of Credit

An overdraft line of credit will automatically transfer funds to your checking account when you do not have sufficient funds to cover a transaction. Funds are transferred in $100 increments up to your established credit limit.

Because this is a loan, daily interest is charged on the outstanding balance. If there is no balance, no interest or fees are assessed.

Key features

- Low, fixed rates.

- $500 minimum line of credit.

- Pay no transfer or annual fees.

Rates effective January 27, 2026. All rates, terms and special offers subject to change. Certain restrictions apply.

Already have an RCU account?

(We’ll pre-fill your application)

New to RCU?

(Only takes 10 minutes, eligibility requirements below)

Eligibility

You can apply for a loan through RCU if you meet any of the following criteria:

- You live, work or own a business in the counties of Sonoma, Marin, Napa, Mendocino, Lake, San Francisco, Solano, or Contra Costa.

- You are an immediate family member of a current RCU Member.

- You work for a designated Select Employer Group.

Overdraft Pay Advantage

Sometimes an unexpected life event or occasional mistake can leave your checking account short of funds. Our optional Overdraft Pay Advantage (OPA) program can cover you if you unexpectedly overdraw your account.

RCU charges a $14 Overdraft Pay Advantage fee (see our Cost Recovery Schedule), which is lower than the industry average of $33. While a fee might seem inconvenient, this service can be a benefit to cover important payments when you need it.

RCU does not charge Members more than 4 OPA fees per day on an account and does not charge daily fees or interest for the negative balance. After a transaction is paid, you’ll be asked to make a deposit to cover the negative balance in your account immediately, and no later than within 20 days.

Key features

- Convenience and protection if you overspend.

- Pay less than the industry average OPA fee.

- Can provide payment to other institutions to help avoid incurring their late/return fees on large payments such as mortgages or rent.

- Choose OPA to cover only checks and electronic transfers (ACH), or Checks, electronic transfer(ACH) and debit card transactions.

Q: What amount is covered by Overdraft Pay Advantage and is it guaranteed?

A: The amount RCU will cover with Overdraft Pay Advantage varies and is based on account standing and history. Typically, RCU will cover up to at least $100 for an Overdraft Pay Advantage transaction, but this is not guaranteed. If your account is not in good standing or you have not made regular deposits into your account, we may not be able to extend Overdraft Pay Advantage services to pay your transaction.

RCU will consistently allow your account to go in the negative up to $25.00 depending on your selected OPA coverage, based on available balance. After initial $25.00, standard Overdraft Pay Advantage fees apply. The maximum amount RCU will cover is $1,500 for personal accounts and $2,000 for business accounts.

Q: Are there any limits to the fees charged for Overdraft Pay Advantage?

A: Yes. RCU recognizes that unexpected events can occur and potentially result in multiple fees before you may become aware of the situation. For this reason, RCU does not charge Members more than 4 fees related to OPA services per day on an account. In addition, RCU does not charge daily fees or interest for the negative balance.

Maximum Protection

Q: What amount is covered by Overdraft Pay Advantage and is it guaranteed?

A: The amount RCU will cover with Overdraft Pay Advantage varies and is based on account standing and history. Typically, RCU will cover up to at least $100 for an Overdraft Pay Advantage transaction, but this is not guaranteed. If your account is not in good standing or you have not made regular deposits into your account, we may not be able to extend Overdraft Pay Advantage services to pay your transaction.

RCU will consistently allow your account to go in the negative up to $5.00 without a fee. The maximum amount RCU will cover is $1,500 for personal accounts and $2,000 for business accounts.

Q: Are there any limits to the fees charged for Overdraft Pay Advantage?

A: Yes. RCU recognizes that unexpected events can occur and potentially result in multiple fees before you may become aware of the situation. For this reason, RCU does not charge Members more than 4 non-sufficient fund fees related to OPA services per day on an account. In addition, RCU does not charge daily fees or interest for the negative balance.

Email & Text Alerts

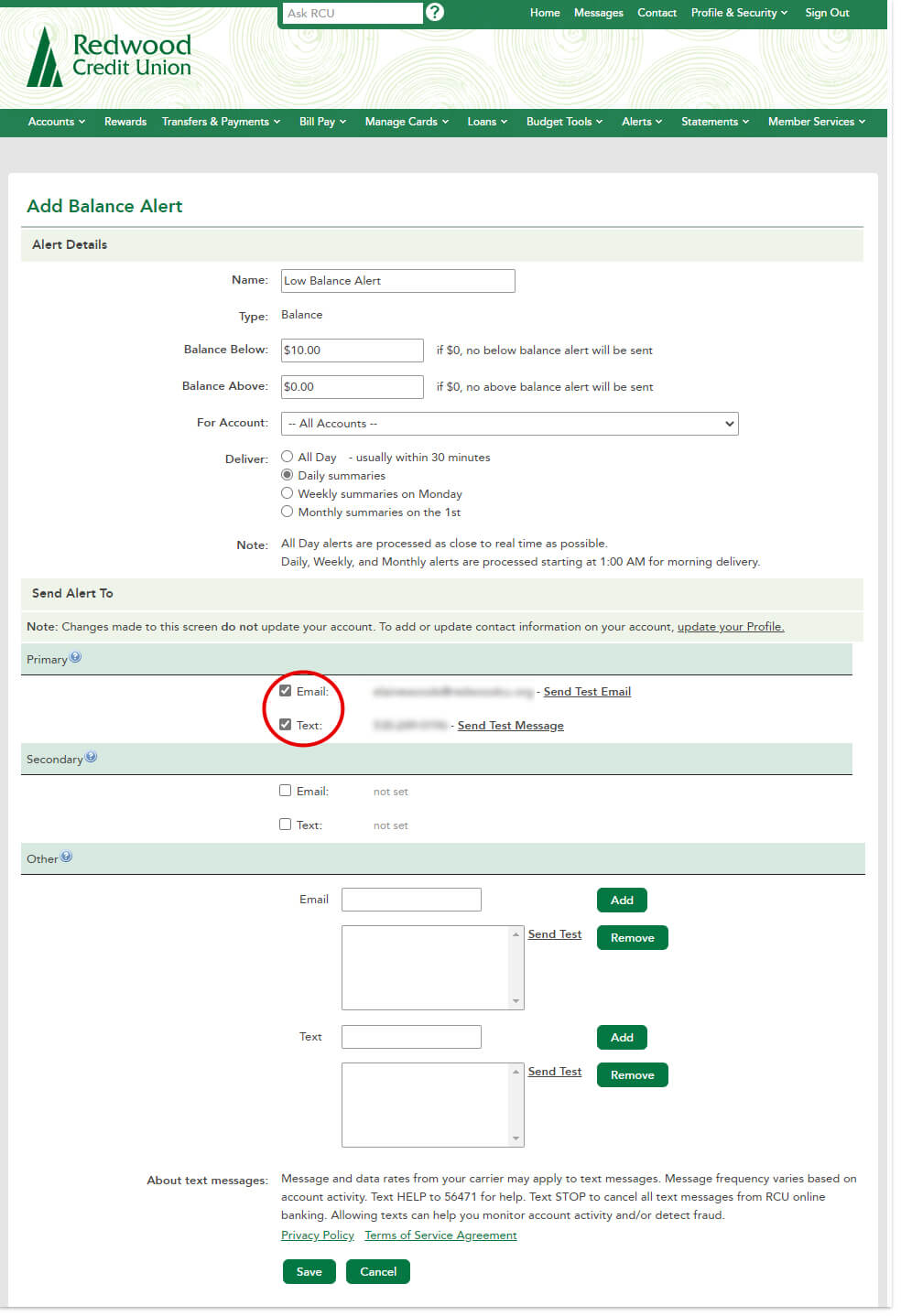

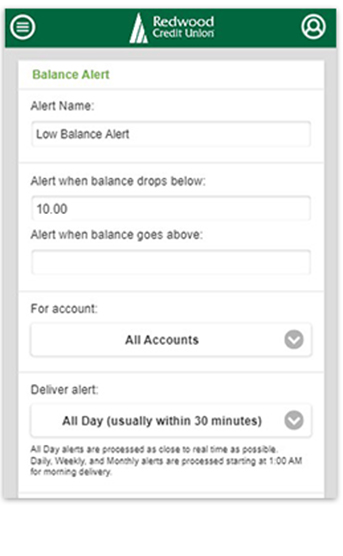

Set up alerts on your account to receive notifications when your balance falls below a dollar amount you choose.

-

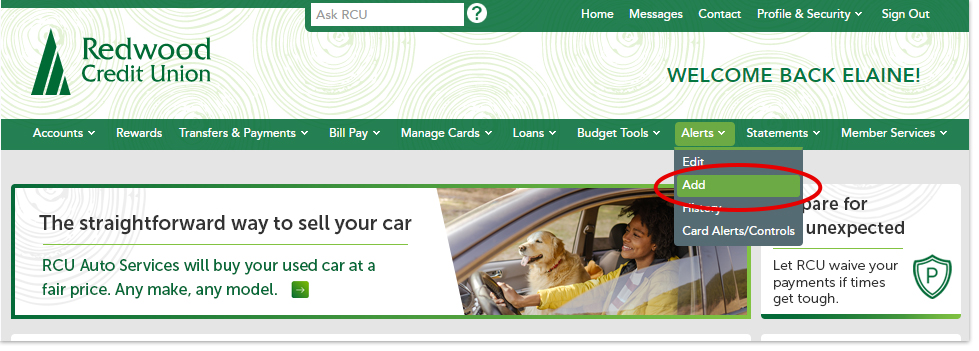

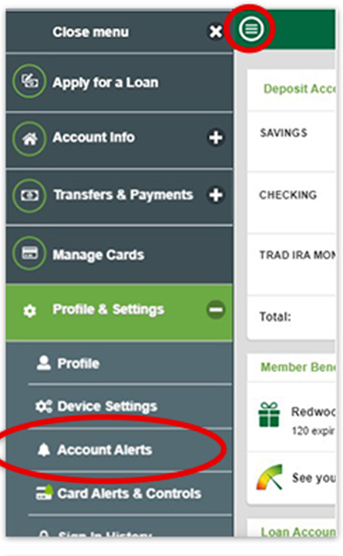

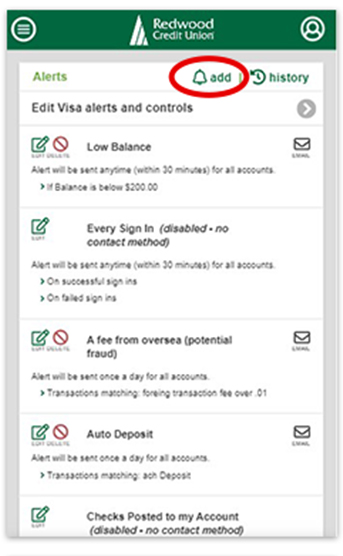

- Log in to online banking.

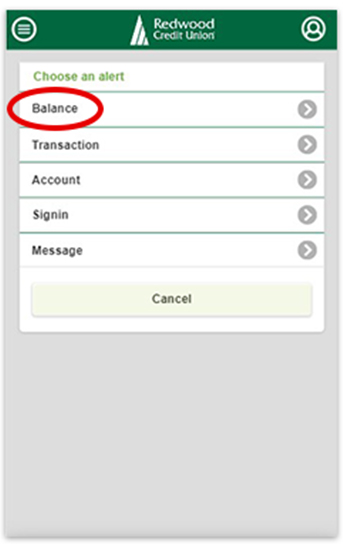

- From the Alerts menu, select Add.

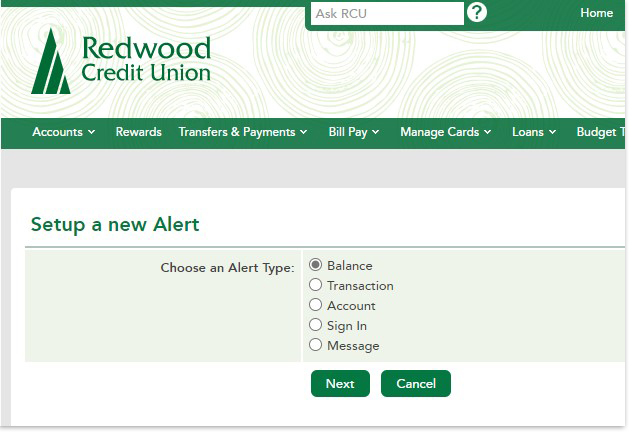

- Select Balance as the alert type, then enter the balance amount at which you’d like to receive an alert, frequency, and how you’d like to receive alerts.

-

PPP Forgiveness Application Deadline

Congress passed The Economic Aid Act which changed the deferment period from 6 months post covered period to 10 months post covered period. For example, if your covered period ended June 30, 2021, under the new guidelines the earliest your first loan payment wouldn’t be due until April 2022, and you have until then to request forgiveness. Please use the following calculation to help you identify when your forgiveness will be due:

- PPP borrowers may select a covered period anywhere from 8 weeks to 24 weeks.

- RCU is automatically calculating your loan due date based on a 24-week covered period, if you intend on using a shorter covered period please inform us immediately as this will impact your due date.

- Your correct deadline will be reflected in your online banking account.

If all or part of your PPP loan is not forgiven, your first loan payment will be due the first of the following month after a decision is made by the SBA.

Leaving Our Website

You are leaving our website and linking to an alternative website not operated by us. Redwood Credit Union does not endorse or guarantee the products, information, or recommendations provided by third-party vendors or third-party linked sites.